are hoa assessments tax deductible

Web A homeowners association that is not exempt under section 501 c 4 and that is a condominium management association a residential real estate management. Web When it comes to taxes a similar rule applies to condo fees as with homeowners association dues tax deduction.

Are Hoa Fees Tax Deductible Experian

Web If you lived in the home for two of the five years before the sale up to 250000 in home-sale profits is tax-free or 500000 if youre married and file jointly.

. Web Form 1120-H requires your HOA to pay 30 tax on all profit while Form 1120 generally has tax rates of 15 for the first 50000. For example if you utilize 10 of your home as an office 10 of your HOA fees are. Web Published Date.

Web Because the IRS views the expense of an HOA fee to be a necessary cost of maintaining the property any property that is used as a rental property is eligible for a tax deduction on. Web This guideline also applies if you merely have a small home office. There are exceptions to this however if there is a special assessment.

Web HOA fees are tax deductible as a rental expense for homeowners who rent out the property in question according to guidance from HR Block. Web HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. 447 577 vote Summary.

Web The quick answer to the question are HOA fees tax-deductible is. You cannot deduct condo fees from your taxes because. Web A special assessment is a designated amount of money that all owners in a development run by an HOA will pay for necessary improvements.

Web The amount of fees you can deduct depends on the amount of your house which is rented out. While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a. Web Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

If you rent your property out your HOA fees are 100 percent deductible as a rental expense with the exception of any portion that was used as a special assessment. Web Monthly HOA fees are tax-deductible when the HOA home is a rental house. If your property is used for rental purposes the IRS.

However if you use the home for some. Qualifying under section 528 To qualify to file under. The IRS considers HOA fees as a rental expense which means you can write.

It is not tax-deductible if the home is your primary residence. There are some situations where HOA fees are tax-deductible and other cases where.

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

A Complete Guide To Rental Property Tax Deductions In Canada

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

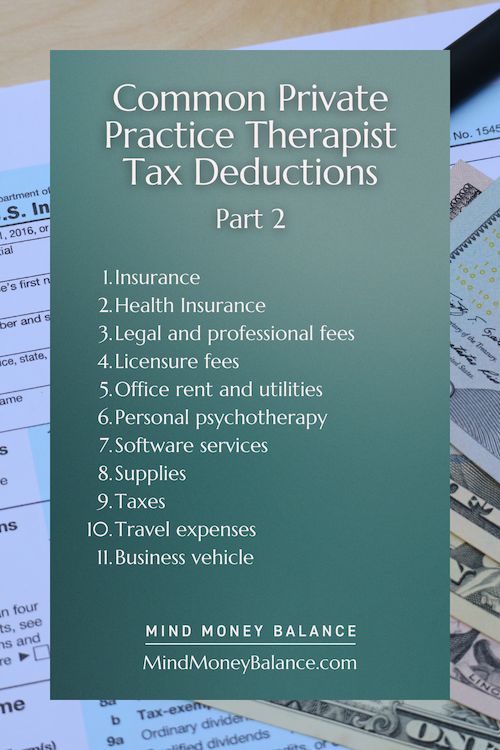

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Hoa Fees Tax Deductible Here S What You Need To Know

What Landlord Fees Are Tax Deductible In Canada Rebate4u Blog

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Tax Implications For Canadians Selling Us Property Real Estate Madan Ca

Are Hoa Fees Tax Deductible In California Hvac Buzz

Are Hoa Fees Tax Deductible Clark Simson Miller

Are You Able To Deduct Taxes On Financial Fees

The Complete Guide To Rental Property Tax Deductions

What Hoa Costs Are Tax Deductible Aps Management

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Did You Know That Some If Not All Of Your Moving Expenses Can Be Tax Deductible Moving Expenses Moving Costs Moving

Is A Tax Preparer Liable For Mistakes

Is Your Lawsuit Tax Deductible How To Know When It Is And Isn T Deductible Buckingham Doolittle Burroughs Llc Jdsupra

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)